Jan 6, 2026

We are proud to provide the latest monthly report for the Sierra Protocol! We will be publishing these regularly to ensure all community members have ready access to the most pertinent information across the Sierra ecosystem.

Please contact us at hello@sierralabs.xyz if you would like to explore partnership opportunities, have any questions, or generally have feedback on how we can improve SIERRA or this report going forward.

Monthly Highlights

Sierra expanded its crosschain footprint via LayerZero and SIERRA can now be bridged from Avalanche to Ethereum

Total circulating market capitalization of SIERRA reached $1.02M TVL on Avalanche and $330K bridged to Ethereum

SIERRA’s yield averaged ~5.8% for the month, positioning it very attractively against top competing Liquid Yield Tokens (approximately 50-150 bps higher yield than sUSDe, sUSDS and SyrupUSDC)

The Summit PEAKS program is in full swing and will run through TGE, which will occur no later than June 30, 2026

Integrations rolled out with top DeFi protocols LayerZero, Turtle and Uniswap, with many more to come

Several funds and fintech partners have onboarded as Authorized Participants to mint/redeem SIERRA directly, and are in various stages of testing to incorporate SIERRA into portfolios and workflows

TVL and Yield

SIERRA is unique in its approach to abstraction, security, transparency and simplicity, providing users with dynamically rebalanced risk-adjusted exposure to a diversified basket of RWA and blue chip DeFi yield sources, all wrapped in a single, non-rebasing composable token. Simply put, SIERRA reimagines what money can be.

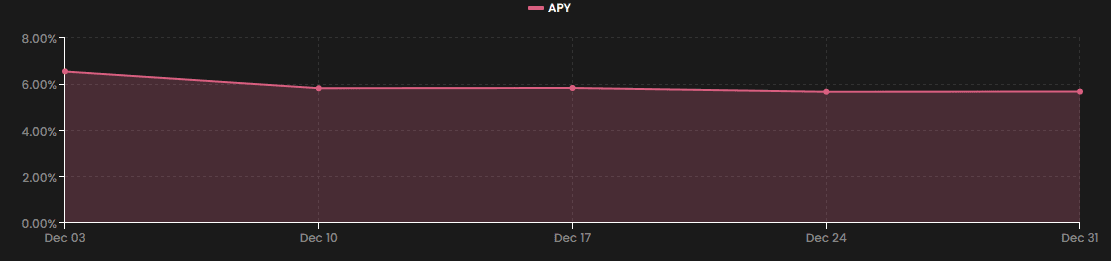

SIERRA targets a competitive volatility-managed and risk-adjusted yield while maintaining maximum liquidity through primary and secondary market venues. As of December 31, SIERRA’s intrinsic yield was a healthy 5.7% after spending most of the month over 5.8%. We have several new vault integrations expected in early Q1, so we expect these yields to become even more competitive in short order, with even better diversification.

SIERRA is designed to reflect accrued yield in its price, rather than rebasing or through interest distributions, thus continuously increasing its exchange rate against USDC over time. This exchange rate is updated every 15 minutes to ensure the most accurate accounting possible as the underlying vaults appreciate in value. The SIERRA/USDC exchange rate can be seen below and can be viewed at any time, along with SIERRA’s APY as well as that of each underlying reserve vault, on SIERRA’s transparency dashboard: https://app.sierra.money/transparency

TVL and Yield

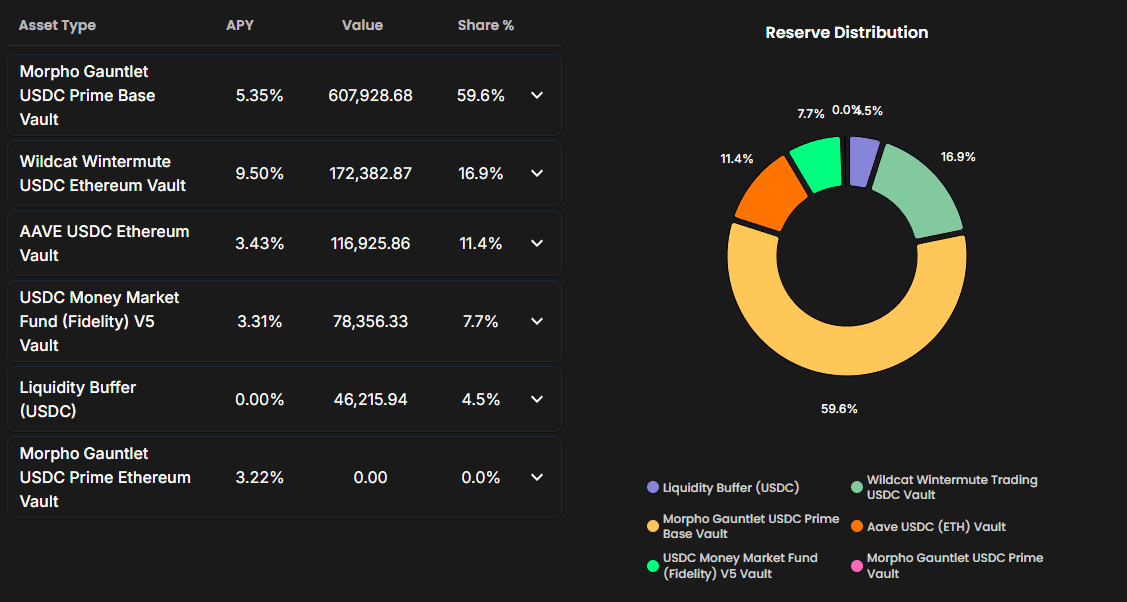

Following our rollout of SIERRA with a fairly limited set of reserve allocations, we began to add new sources in December. Primarily, we added the Gauntlet-managed Morpho USDC Prime vault on Base. This vault largely generates yield from overcollateralized BTC-backed loans to Coinbase users, and earns roughly 5.4% in native yield. SIERRA also reduced allocations to Gauntlet’s Morpho USDC Prime vault on Ethereum as mainnet yields have come under significant pressure, as have most onchain lending rates.

We will be adding a few more yield sources in the coming weeks to further diversify SIERRA’s portfolio, which should also serve to showcase the strength of SIERRA’s flexible architecture. As of December 31, Sierra’s reserve distribution was as shown below:

Partnerships

Our goal is to maximize the utility of SIERRA across DeFi, CeFi and Tradfi through the broadest suite of integrations in the industry. But in order to do so, the foundations have to be in place that first make SIERRA the highest-quality, institutional grade yield bearing asset in the industry. As such, we are proud to announce our integrations and partnerships with the best infrastructure providers in the space:

Redstone is the premier oracle provider for yield-bearing tokens and RWAs, securing nearly $6 billion in value for nearly 100 protocols. SIERRA utilizes Redstone’s smart-contract based fundamental oracle to ensure the most accurate onchain pricing possible for SIERRA. Ultimately, this price feed is what underpins SIERRA integrations across DeFi, enabling a far more robust set of use cases and partnerships. Security is of paramount importance to SIERRA, and Redstone provides that having experienced zero mispricing events or downtime in its history.

LayerZero is the industry leader for cross-chain asset composability, supporting more than $175B in cross-chain asset transfers for nearly 650 protocols spanning 150 chains. SIERRA implements LayerZero’s OFT standard to provide seamless composability and utility on Avalanche and Ethereum, with support for more chains to come.

Turtle is the leading liquidity distribution platform in the industry, partnering with teams to structure information campaigns that help introduce new projects like SIERRA to retail and professional capital allocators. This will be an ongoing campaign as we continue to grow. That campaign can be accessed by anyone here: https://app.turtle.xyz/earn/products/acfc65cd-ec7e-4f10-98d0-4c0a4b7b9a5e

Uniswap is the largest decentralized exchange in the industry, having facilitated nearly $3.5 trillion in aggregate swap volume since going live. In recent months, it has frequently enabled over $100B per month in permissionless swaps.

Summit PEAKS Program

As a reminder, we kicked off our points campaign, referred to as our Summit PEAKS Program, on November 20. Participants are able to earn PEAKS for engaging in a range of activities across DeFi and CeFi with SIERRA. We will continuously roll out new ways to participate as the Program continues.

Participants can view current opportunities and track their progress on our dashboard here: https://app.sierra.money/peaks. Epochs will run from Thursday 0:00:00 UTC through Wednesday 23:59:59 UTC, and updates to the dashboard will be reflected following the completion of each epoch.

Team Commentary

December proved to be an exciting month on the business development side and we are hopeful many of the commitments we secured over the past few weeks will start bearing fruit post-holiday break.

The value proposition of SIERRA immediately resonates with many of the fintechs we meet with, and several have already moved to active testing with SIERRA. The ability to instantly gain exposure to a diversified basket of yield sources with the combination of 24/7 onchain liquidity and direct at-NAV mint/redeem capabilities within 1 business day is proving to be a truly differentiated product in the market. A great problem to have: many have indicated strong interest in allocating far more to SIERRA but are limited to being no more than a certain % of total outstanding TVL. As TVL and liquidity scales, these partners are in a great position to scale with us.

Focus continues to be on rounding out SIERRA as the industry-leader for risk adjusted yields on LYTs. We have several new yield sources that we will be integrating into SIERRA in the coming weeks, which will not only better diversify our reserve allocations, but should also serve to increase yields further while reducing volatility in the yields generated. We expect this to move us into the low-6% yield threshold, but this is naturally impacted by market conditions. These additions will also better highlight the uniqueness of SIERRA’s architecture and serve to showcase what an LYT that spans DeFi, basis and RWA yield sources is capable of being.

2026 will also mark an increase in focus on growing out the DeFi distribution side of SIERRA. We have a few user-focused initiatives coming to market that we expect to support user growth by a few orders of magnitude. To bolster this, we are also strengthening our Turtle campaign with additional yield boosts paid out in the SIERRA LYT, pushing real yields earned by SIERRA holders to nearly 10% before Peaks and other incentives are included.

Work has begun on speccing out the next iteration of the Sierra Protocol - and we very strongly believe that our long-term roadmap is going to turn heads in the industry. We will release more details on that soon.

As always, we are excited to have you join us as we build this novel protocol into the industry-leading liquid yield token issuer, with SIERRA as our flagship LYT. Stay tuned as we continue to roll out updates over the coming weeks and months, and please reach out if you would like to work together in any way.

Thank you for your time and attention, and welcome to the Sierra Community!

Sincerely,

Mitch and Kevin