Dec 9, 2025

We are proud to provide the first ever Sierra Monthly report. We will be publishing these regularly to ensure all community members have ready access to the most pertinent information across the Sierra ecosystem.

Please contact us at hello@sierralabs.xyz if you would like to explore partnership opportunities, have any questions, or generally have feedback on how we can improve SIERRA or this report going forward.

Highlights

Sierra officially brought our first product to market, the SIERRA liquid yield token (LYT), natively issued on Avalanche

Total circulating market capitalization of SIERRA reached $787,000 and yields averaged above 5% for the month.

The Summit PEAKS program launched on November 20 and will run through TGE, which will occur no later than June 30, 2026

Integrations rolled out with institutional-grade infrastructure providers OpenTrade, Flowdesk, Fireblocks and DeFi app LFJ, with many more to come

Introducing the Sierra Protocol and our flagship SIERRA liquid yield token

November 13 marked Sierra’s official public release, with our flagship SIERRA liquid yield token launching natively on Avalanche and built in close partnership with OpenTrade, the leading institutional-grade yield-as-a-service provider. SIERRA is unique in its approach to abstraction, security, transparency and simplicity, providing users with dynamically rebalanced risk-adjusted exposure to a diversified basket of RWA and blue chip DeFi yield sources, all wrapped in a single, non-rebasing composable token. Simply put, SIERRA reimagines what money can be.

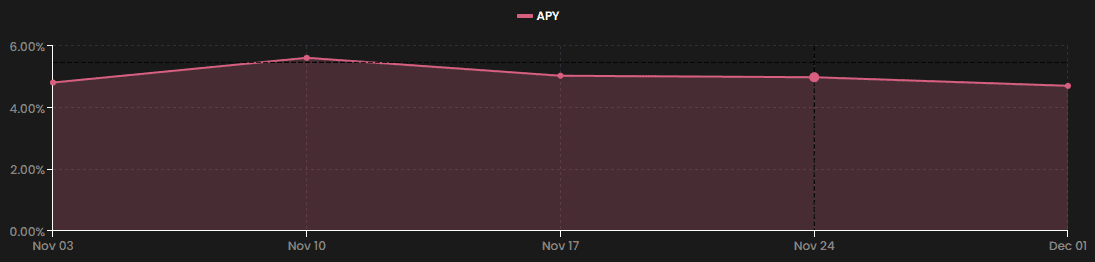

SIERRA targets a competitive volatility-managed and risk-adjusted yield while maintaining maximum liquidity through primary and secondary market venues. As of November 30, SIERRA’s intrinsic yield was 4.8%, but averaged above 5% throughout much of the month. With new yield vault integrations on the immediate horizon, we expect these yields to become even more competitive in short order.

SIERRA is designed to reflect accrued yield in its price, rather than rebasing or through interest distributions, thus continuously increasing its exchange rate against USDC over time. This exchange rate is updated every 15 minutes to ensure the most accurate accounting possible as the underlying vaults appreciate in value. The SIERRA/USDC exchange rate can be seen below and can be viewed at any time, along with SIERRA’s APY as well as that of each underlying reserve vault, on SIERRA’s transparency dashboard: https://app.sierra.money/transparency

Reserve Allocations

SIERRA’s design introduces an industry-first dynamic reserve management mechanism that spans a range of USDC-denominated bluechip DeFi and RWA allocations, in adherence to our Risk Framework as set by Sierra’s Risk Advisory Council. This allows us to tactically adjust portfolio allocations towards the best risk-adjusted opportunities as the market changes. We intentionally launched with a relatively narrow and conservative reserve mix - predominantly bluechip Ethereum DeFi - but new yield sources will be added over time per the Risk Framework. A full real-time breakdown of reserves are available at all times at https://app.sierra.money/transparency.

As of November 30, Sierra’s reserve distribution was as shown below:

Integrations

Our goal is to maximize the utility of SIERRA across DeFi, CeFi and Tradfi through the broadest suite of integrations in the industry. But in order to do so, the foundations have to be in place that first make SIERRA the highest-quality, institutional grade yield bearing asset in the industry. As such, we are proud to integrate and partner with the best infrastructure providers in the space:

OpenTrade provides the foundational infrastructure for SIERRA’s reserve management strategy, ensuring our reserve vaults are bank-grade quality out of the gate. OpenTrade is a yield-as-a-service provider backed by top funds such as a16z Crypto, Mercury, CMCC and Circle Ventures.

Fireblocks is the top custody provider in the industry, used by over 2,400 funds and institutions around the world that need the highest-quality custody services possible. To date, Fireblocks’ MPC technology has enabled over $10T on-platform transactions to date.

Flowdesk is a global full-service trading and technology firm that provides institutional-quality liquidity across more than 140 centralized and decentralized exchanges and OTC. Flowdesk’s participation ensures SIERRA can operate efficiently across secondary markets while maintaining full compliance and transparency.

Avalanche is increasingly cementing its position as one of the top ecosystems for onchain RWAs with over $700M in assets currently accessible and tradable and another $300M leveraging the security and immutability of Avalanche’s network.

LFJ, on Avalanche, is the largest hub for liquidity, enabling permissionless secondary market liquidity for SIERRA<>USDC swaps. LFJ has facilitate nearly $180B in DEX volume since going live in 2021.

Expansion to new chains and broader DeFi utility is coming soon, stay tuned.

Summit PEAKS Program

We kicked off the first epoch of our points campaign, referred to as our Summit PEAKS Program, on November 20. Participants are able to earn PEAKS for engaging in a range of activities across DeFi and CeFi with SIERRA. We will continuously roll out new ways to participate as the Program continues. Participants can view current opportunities and track their progress on our dashboard here: https://app.sierra.money/peaks.

Epochs will run from Thursday 0:00:00 UTC through Wednesday 23:59:59 UTC, and updates to the dashboard will be reflected following the completion of each epoch.

Generally, we designed this Program to be as simple as possible while still optimizing for impact:

The Summit Program will conclude with the Token Generation Event (TGE) for the Sierra Governance Token (SGT), which will conclude by the end of June 2026 at the latest.

At TGE, Peaks will convert to SGT based on the share of the total supply of SGT allocated to the Summit Program - and at least 30% of the total SGT supply will be allocated to participants in the Summit Program.

There will be at most 100,000,000 Peaks issued throughout the entire Program and distribution is linear, which means that the Summit Program does not provide additional incentives to participants who spread their activity across multiple addresses or attempt to otherwise game the Program. Rather, continuous, long-term organic participation will be prioritized.

There will be no vesting, penalties or similar mechanisms on SGT received at TGE.

A more detailed explanation of the Program can be found here: https://sierra.money/blog/sierra-summit-program and a post exploring the guiding principles behind the Program can be found here: https://sierra.money/blog/where-points-campaigns-can-be-improved

Team Commentary

We are excited to finally have the opportunity to share SIERRA with the industry and believe we are bringing to market a product that solves some of the most acute pain points that are still plaguing users. Specifically, SIERRA completely abstracts a diversified, risk-adjusted portfolio of USDC-denominated yield generating strategies, entirely eliminating the need for manual reserve and collateral management, staking or claiming, while optimizing for tax efficiency, maximum liquidity and integrations across DeFi and CeFi use cases. Said another way, SIERRA provides the best-possible user experience and exposure to a basket of DeFi and RWA-backed yield sources, built from the ground up with best-in-class institutional infrastructure, fit for retail and enterprise use alike.

In building Sierra, we are driven by two major ideals:

Building the SIERRA liquid yield token into the exact DeFi asset that we would want to hold and use on a daily basis as veteran crypto users and professional investors

Building the Sierra protocol into the best possible example of what onchain, token native organizations can be

Every single design decision we make across the protocol works to advance us towards these two ideals. Our focus on simplicity, transparency, professionalism and long-term sustainability are all reflections of this. Of course, it is easy enough for us to say all of this, but we understand that what ultimately matters is the experience we provide our users and community members. This will be the single most important metric against which we will measure our success, and we endeavor to prove this out to our users and community.

To be honest, launching SIERRA shortly after the October 10 flash liquidation event, subsequent collapse of several yield bearing stablecoins, and massive redemptions across most top DeFi protocols isn’t exactly the ideal backdrop we had in mind for our big debut. Appetite for risk - especially untested new yield protocols - is fairly depressed, and for good reason. But the silver lining of recent events is that our deliberate, risk-minimized and simple approach has been strongly validated and the responses we have received when introducing SIERRA have been overwhelmingly positive.

SIERRA is designed to reduce user exposure to the pitfalls, obfuscation and embedded risk and complexity that many ‘rival’ yield-bearing assets expose their holders to. We grow increasingly confident that SIERRA is the asset that many users want to hold, or even perhaps thought they had been holding in the first place.

We are excited to have you join us as we build this novel protocol into the industry-leading liquid yield token issuer, with SIERRA as our flagship LYT. Stay tuned as we continue to roll out updates over the coming weeks and months, and please reach out if you would like to work together in any way.

Thank you for your time and attention, and welcome to the Sierra Community!

Sincerely,

Mitch and Kevin